DoorDash: Re-Inventing Last-Mile Logistics

‘’America is the land of the free and the land where you never need to leave your house. No item is too trivial to be hand-delivered into your home, like an emperor.’’ Comedian Ronny Chieng, in 2019.

On the surface, DoorDash seems expensive at 17x LTM Sales with difficult comps ahead, a seemingly unjustifiable price based on traditional valuation techniques. But the right way to look at DoorDash is by focusing on DashPass, the high-margin subscription offering that allows consumers to order and receive any good in their city within minutes with free delivery. The offering has parallels with Amazon Prime and increases customer stickiness.

The DoorDash of today isn’t the end state DoorDash. DoorDash is aggregating consumers, Dashers and merchants on its platform and adding great value to each party. This paves the path for the company to one day dominate last-mile logistics and upsell their customers with higher-margin products and services. Each new vertical DoorDash makes available to users will help achieve achieve greater density and offer additional benefits to users. The end state DoorDash will have great barriers to scale, as well as the most consumers, the widest selection of merchants and Dashers. With the advantages of scale, DoorDash will offer its merchants and users the lowest costs and the highest earnings potential for Dashers.

Creation Story

While studying at Stanford Business School, Tony Xu and his co-founders chose to solve a problem for small businesses for a class project. They developed an app which helped restaurants track where their customers came from. Unfortunately, when visiting several of their target customers, Xu and his friends found their solution wasn’t needed by merchants. The effort wasn’t a total dud though. During one visit, the owner of a 1-person dessert shop showed Tony her delivery order book, which contained entire pages worth of deliveries she couldn’t fulfill. She was only a 1 -person shop and didn’t have the resources to hire delivery people. That was the insight that made the idea lightbulb flash for Tony.

That insight was that he wanted to help merchants deliver to their customers. This mission is even more important today, since consumers are no longer going to physical storefronts for every purchase and many local businesses lack the capabilities to reach today’s consumers or deliver to them off-premise.

I view DoorDash’s mission as similar to Shopify. The Canadian company empowers small merchants to compete against Amazon on several fronts, such as fulfillment & shipping, smooth customer experience through website customization, inventory management, etc. Similarly, DoorDash allows its merchants to compete against behemoths like Domino’s. The famous pizza retailer isn’t known for its great pizza but rather its focus on convenience through quick delivery time, consistency and a large base of 20M users who have the Domino’s app on their phone. DoorDash allows its merchants to compete on several of these criteria, including quick delivery and access to a large installed base of 21M users who have the DoorDash app.

Product offerings

DoorDash takes a delivery fee, a service fee, and a commission from merchants on each transaction. DoorDash also has a membership program called DashPass, where customers pay 9.99$ a month for unlimited deliveries from eligible merchants. In the future, consumers will access not only restaurants, but all the local businesses in the community, and receive benefits while shopping in-store, at home or anywhere in between.

A vision for last-mile logistics

‘’While food itself is a category that has a long runway for growth, we believe the network we have built ideally positions us to fulfill our vision of empowering all local businesses to compete in the convenience economy.’’ -DoorDash S-1

The DoorDash of today isn’t the end-state DoorDash. Tony Xu envisions a DoorDash that will own all last-mile logistics. DoorDash started delivering for restaurants since it’s the highest frequency activity they can cater to. Hot meals are the hardest product to deliver, since they are perishable and every minute matters. Once hot meals are tackled, non-perishable items’ delivery becomes far easier to coordinate. Tony wants to digitize the physical world and bring users everything inside a city to their doors.

One of these verticals DoorDash is leading is the online convenience category, where they are the largest American player after only a year of launching. They ended 2020 with 58% market share in the category. Instacart and Uber Eats each have only 8% of the market. Consumers like immediacy, with the ability to press a button and have their favorite ice cream delivered in under 25 minutes. DoorDash already has strategic partnerships with CVS Pharmacy, 7-Eleven, Wawa, Walgreens, Albertsons and even Macy’s.

DashMart, DoorDash’s online convenience offering, has 2500 convenience stores across more than 1100 cities nationwide. Customers go to the online storefront and purchase all the most-desired local convenience items in an area and then have those items delivered in 30 minutes or less by way of these micro-fulfillment warehouses, run by DoorDash. These micro-fulfillment warehouses are useful to increase node density, similar to how Walmart’s physical stores help for node density.

As DoorDash increases the amount of merchant partners and these micro-fulfillment warehouses, its route density increases, and so do its order per hours. Orders per hour increasing also increased Dasher earnings, who then have little incentive to churn towards another delivery or ride hailing platform. We are already seeing it happen, with Dasher delivery frequency up 46%, from Q2-2017 and Q2-2020. The company has flown some of this through its own P&L with cost per order down 22% and passed some along to Dashers with earnings per order 24% over the same time period. Increasing volumes also mean Dashers are put in front of the right order and not ask Dashers to go wildly out of their way.

Density also where DoorDash merchants will increasingly compete with Domino’s. The pizza retailer achieved density by splitting and subdividing franchise store territories which generate a virtuous cycle where proximity leads to better service, translating to more orders, which incentivizes delivery drivers to work for Domino’s. Domino’s drivers have increased deliveries per hour from 2.5 to 5 in its densest areas. This attracts labor in tight markets and made sourcing labor very competitive. Their average delivery time is 22 minutes. Until DoorDash came along, it was difficult for small and large merchants alike to compete on convenience, delivery and price with Domino’s. Once Domino’s fully penetrates a market, their marginal cost to serve a new delivery customer is far lower than a potential new entrant leading to a sustainable cost advantage.

Similar to the way Square aggregated its merchants to get better payments processing rates, DoorDash is aggregating its merchants to achieve greater density, and their drivers can deliver far more orders as well. Other differentiating factors for Domino’s included their technology platform, which had a rewards system, electronic customer profiling and geo-tracking of pizzas being delivered. These features were appreciated by Domino’s 20M customers and contributed to a great user experience. However, DoorDash’s 390 000 merchants now benefit from all these nifty tech features as well as affordable delivery services to their customers. Domino’s competitive advantage is eroding and DoorDash’s is emerging.

Optionality

Being the winner of the winner-take-most game that is last-mile logistics will grant DoorDash several spoils of victory, allowing it to stack on new products and services to its platform. Now that there is a well-populated graveyard of failed food delivery startups and a winner (DoorDash) is emerging, DoorDash can add on more products. They will deliver more value to the merchant base, while monetizing them. They currently have a SaaS offering for larger chains that allows them to control the whole delivery experience. 40% of DoorDash’s merchants do not have an online ordering system and rely on 3rd party platforms for demand generation. DoorDash Storefront allows them to have an online store themselves, with orders coming directly at them, at the click of a button, while DoorDash still fulfills requests and takes a cut. These mission critical services serve to reduce merchant churn rates.

As DoorDash aggregates merchants on its platform, they can use the delivery offering as a Trojan horse for extra functionalities, such as Point of Sales systems. Meituan, the Chinese delivery company, did exactly that and even went upstream by aggregating inventory suppliers on their platforms and negotiating bulk discounts on behalf of their merchants.

Another offering which DoorDash provides is grocery. The market is massive, at 765B$, with low e-commerce penetration (10% in 2020) and frequency behavior (2.7 trips per week), so grocery delivery will improve the probability of batching (combining multiple orders from 1 vendor) and chaining (combining multiple orders from multiple orders). Laying the food delivery base gives DoorDash the best chance at obtaining the holy grail product offering, the ability to order any product and receive it on demand.

Cloud kitchens and DashMart are part of DoorDash’s effort to move from just a 3P platform to 1P, which will increase their selection available to users, thus increasing their market power. The move reminds me of Roku (another favorite holding of mine), which recently moved exclusively from being a 3P platform to having its own content. In both cases, owning the distribution gives the companies an opportunity to hold on to their market leadership position and keep on delighting their customers.

Indeed, DoorDash is offering cloud kitchens, which increase the supply of restaurants on their platform and drive greater efficiency in delivery operations given multiple restaurants in one location. Merchants benefit from improved cost structure since they can leverage the infrastructure costs DoorDash made and produce food only, without worrying about the aesthetics, expensive equipment and storefront of the restaurant. Indeed, all the restaurants need to provide is kitchen staff. The concept of cloud kitchens is similar to start-ups using public cloud computing from the beginning as opposed to investing in their own data centers. A CNBC report claimed the take rate for users of cloud kitchens would be roughly 25% to 3rd-party delivery platforms like DoorDash, much higher than the take rate on DoorDash’s marketplace delivery business of 12%.

Cloud kitchens will soon become an easy way for influencers to monetize their large followings. For example, YouTube personality, MrBeast, recently launched 300 virtual MrBeast Burger restaurants nationwide available in its own app as well as on third-party delivery apps. Almost immediately after launch, the MrBeast Burger app crashed and they had to upgrade the servers. The ease of use of cloud kitchens will greatly increase the TAM of selling food. For example, the easiest way for influencers to monetize their followings used to be selling apparel -now they have cloud kitchens too. Shopify COO Harley Finkelstein speaks often of Shopify lowering the costs of entrepreneurship to 0 for its partners. With offerings like the cloud kitchen and Storefront, DoorDash is doing the same by democratizing opening a restaurant. Cloud kitchens, new verticals like grocery and additional merchants all increase the ability to batch orders since the physical buildings will increase density. These offerings increase my confidence in DoorDash increasing its deliveries performed per hour.

DoorDash’s advertising business is just starting but should become significant over time. DoorDash serves as an important source of new customers for merchants with a much higher conversion rate vs other advertising platforms, since the users are already on the app looking for what to eat. Meituan, its Chinese peer, generated marketing services revenue that was 2% of food delivery GMV each quarter. DoorDash advertising is at less than 1% of GMV today. The SaaS offering, cloud kitchen and advertising revenues are not material right now but have great growth potential.

Value-add to each player in the ecosystem

Merchants

DoorDash provides merchants with a new demand creation channel. ‘’It’s like being open 8 days a week’’, said one merchant. DoorDash provides the opportunity to reach new consumers, grow their business, and benefit from incremental sales that leverage the fixed cost investments they’ve already made. DoorDash creates demand for merchants through personalization and merchandising strategies that curate selection.

80% of delivery orders are incremental to merchants’ on-premise businesses, enabling them to serve a new class of customers and leverage fixed costs. 65% of merchants even feel profits increased during Covid due to DoorDash. DoorDash also provides several services to merchants allowing them to solve mission-critical challenges. For example, DoorDash provides DD Drive, a white label fulfillment solution which allows merchants that can already generate demand through their own sites and apps to fulfill orders using DoorDash’s delivery service. The service enables restaurants as well as all brick-and-mortar merchants to queue up a DoorDash driver on demand. This service is important for Dasher retention since it gives them a way to get delivery requests during off-peak hours. Not even Amazon has the scale nationally to get a product from point A to point B within a city in 37 minutes. DoorDash knows better how to deploy delivery service in just-in time form. Only a select number of players will be able to provide this white-label service at scale. For example, Walmart had to cancel its partnership with Skipmart, one of its white-label delivery partners (and competitor to DoorDash Drive), since Skipmart couldn’t make the unit economics work. Because the white-label delivery market will eventually consolidate within just a few players, these victors will have pricing power at maturity.

Next, partners of the platform have great optionality by being listed on DoorDash. Small merchants providing delicious food, quick food preparation and positive resulting customer reviews can be surfaced very high on the app, thanks to the DoorDash algorithm. This feature would allow a small burrito restaurant to rival with the likes of Chipotle.

Even DoorDash’s fiercest critics are joining the platform. After releasing an ad campaign in February 2019 saying it would never authorize a 3rd party delivery company to transport its sandwiches, Jimmy John’s announced in December 2020 it would join DoorDash, but offer in-house delivery, showing the power a customer aggregator holds. 120 000 such restaurants offer in-house delivery and are lured by the promise of a large customer base. Every merchant that joins the DoorDash platform makes the platform more attractive to users and places hold-outs at a disadvantage, an insight Jimmy John’s recently realized. Indeed, 175 of the top 200 food chains in the US are listed on DoorDash. I believe DoorDash will become the gatekeeper for restaurants, just as Roku became a video streaming gatekeeper. Restaurants not on the platform will be missing out on valuable sales.

Dashers

Because DoorDash has the most restaurants, they also have the most Dashers. Since DoorDash has the most restaurants of all food delivery platforms in the US, Dashers know they can pick up more orders, and thus do more deliveries, increasing their earnings. As DoorDash gains scale and delivers products beyond food, I believe they will be able to offer greater wages to Dashers. This kind of guarantee would lock Dashers into the DoorDash ecosystem and prevent Dasher churn, which is the reason Costco and Amazon offer their customer a relatively high 15$/hour wage.

According to online reviews, delivery people for various platforms are concerned delivery requests only come occasionally for less-used platforms like Instacart. But for DoorDash, one gets multiples more delivery requests in the same amount of time. Dashers place great value on their time, as do DoorDash’s users. 90% of Dashers work less than 10 hours a week, often in blocks. They are looking for flexibility and value in the hours they work, making a steady influx of delivery orders crucial to keep Dashers satisfied.

The highest utilization & wages per delivery will keep Dashers engaged, as the company is working hard to keep their couriers busy. The higher density of Dashers that DoorDash achieves allows them to have the best chance of delivering the fastest and most consistent experience, thanks to their fleet being the largest.

For Customers

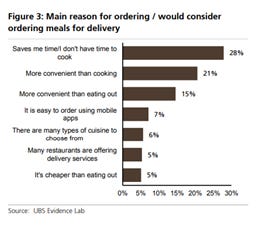

The most important benefit for customers is convenience, as users can get the best their cities have to offer within minutes, saving valuable time. Time saving is the top benefit customers appreciate about food delivery. The average delivery time for DoorDash is just 35 minutes, which has decreased by 23% in the past couple of years. This lower delivery time is a consequence of having the most delivery people on its platform.

DoorDash offers its customers a wide selection of customers, through their wide selection of restaurants. Indeed, 65% of DoorDash customers reported trying a new restaurant they otherwise would not have because of its availability on DoorDash. This broad selection is coupled with personalization and curation. For example, DashPass was created to reward its most engaged consumers with free delivery and in turn rewarding restaurants by featuring them to their most engaged customers.

Why DoorDash is the best of the American food delivery platforms

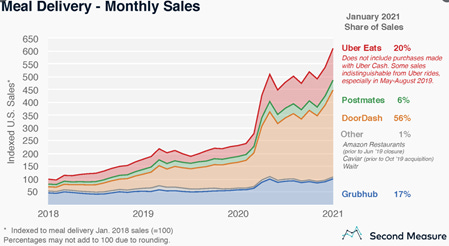

DoorDash has 56% market share in the US, despite starting their delivery business long after the first entrants. This is because DoorDash has successfully tipped the flywheel in its direction, at the expense of competitors by gathering the most merchants, Dashers and customers.

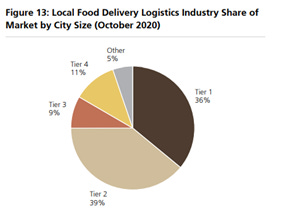

DoorDash started their business with a strategic focus on suburban markets and smaller metropolitan areas. Other platforms which entered the food delivery market first focused on cities because of their greater density of people and restaurants, leaving the suburbs to be underserved. Residents in suburban markets are more impacted by the lack of alternatives and the inconvenience posed by distance and the need to drive to merchants. These consumers are more likely to be families who order more items per order. Lighter traffic and easier parking also mean that Dashers can serve these higher growth markets more efficiently. This strategic focus on urban markets is validated by the fact that category share in suburban markets increased by 35% between January 2018 and October 2020. These suburbs (lower tier cities) saw greater growth than denser cities and have greater market share, as most Americans live in the suburbs, according to Bloomberg.

Next, DoorDash was quite aggressive on its marketplace fee for merchants, waiving it for several months when onboarding a merchant. They also partner very deeply with merchants, such as having a dedicated parking spot and a line in the restaurant for Dashers. They have exclusive partnerships, such as the one with Chipotle where DoorDash provides 50% of all marketing expenses in a year, with their partners. All these efforts are made to streamline operations for both the restaurant and the platform.

Competitive Positioning

Overall, DoorDash’s early focus on their 3-sided marketplace differentiated it from competitors. Uber had a two-sided marketplace (riders and drivers) and introduced restaurants into their ecosystem as a 3rd party only while maintaining the efficiency of their incumbent business model, and sacrificed selection. Grubhub viewed an in-house delivery network as a commodity and never invested the time to build one. They focused on their lucrative marketplace business which generated growing EBITDA.

DoorDash focused instead on investing heavily in their delivery offering to create the best consumer proposition and earnt its market leadership after spending heavily on customer and delivery acquisition. A similar consumer mentality shift will happen for free online food delivery as it did in e-commerce, where customers also grew used to free shipping. DoorDash’s growth has been fueled by 2.5B$ in VC funding, which allowed these notable share gains. A new competitor would have to spend heavily as well on customer and fleet acquisition before even beginning to aggregate merchants in every single city on their platform.

So DoorDash has a better flywheel and product experience, which explain its 56% market share, as well as Grubhub’s market share falling from 43% in 2018 to 17% in 2021. DoorDash does 2x the US GOV of Uber Eats and 3x that of Grubhub. Eventually, rationalization will occur, similar to the food delivery market in China, where irrational competition and heavy VC funding subsided and the market share between the national players Meituan and Alibaba stabilized at 65/35.

In the end state, DoorDash will be the local, faster Amazon. DoorDash was clear in their S-1 about Amazon being a competitor, and DoorDash will become an Amazon for mobile covering a 45-minute radius of anything users want. Amazon is an important player in last-mile delivery as a service, but a large part of the market among brick and mortar retailers prefer not to work with Amazon given how competitive it is with local merchants, leaving plenty of room for players like DoorDash. I have confidence in DoorDash to perform better than Amazon with local deliveries. For example, Amazon Restaurants, Amazon’s food delivery platform, was shut down in June 2019. It was offered in only 25 cities and they made the mistake of launching the platform on a national scale, not city by city.

Servant-leadership

The culture of servant-leadership at DoorDash is unique and I suspect it played a role in making DoorDash the market leader. Tony and DoorDash employees spend 1 day a month as Dashers, or support customers or merchants, which has been crucial to provide hospitality towards all stakeholders of their flywheel. Tony himself does customer service every single day to find hidden, under-the-surface problems to get the lowest level of details. Tony and its co-founders even did deliveries for Fedex and Domino’s at the very beginning of their journeys to learn about logistics.

The data collection efforts generated a large proprietary data set for DoorDash, which they use to make operations more efficient, generate more marketplace transaction volume and create economic lift for all marketplace restaurants. The data platform is a growth engine that powers experimentation across the food delivery cycle, ad images, menu presentation and pick-up time for Dashers by market, down to the single minute depending on weekday and time of the day.

Their obsession with serving their customers even impacts their wallets. DoorDash had an outage in their 3rd month of operations, and they refunded all consumers their order amounts, which took a big chunk out of their small bank accounts at the time. As the pandemic began, DoorDash also reduced commissions by 50% for local restaurant partners with 5 or fewer locations. This stakeholder goodwill will reap its benefits later on.

TAM

While the shock of the pandemic accelerated demand for food delivery, DoorDash will continue being convenient, and perhaps even more as lockdowns are lifted and people live normally. We won’t have as much time with kids and family. The chart to the right shows the reasons why users order pick-up/delivery and they will continue to be valid after the pandemic. Families and individuals don’t have as much time for meal preparation, and food delivery is an easy time-saving solution. People will be ordering online to save time for concerts, sports and other entertainment.

US DoorDash consumers are currently just 6% of the population, and we are in the early phases of broad market adoption. According to UBS, DoorDash has marketplace Gross Order Value of less than 3% of the 600B$+ of the food off-premise opportunity. This 600B$ figure doesn’t take into consideration the TAM of pharmacies, convenience store food, grocery delivery either so DoorDash is likely operating in a trillion-dollar plus TAM.

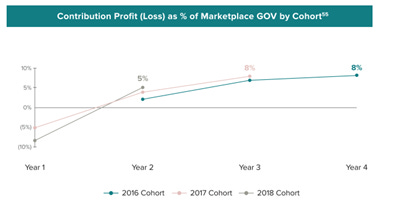

Unit economics and valuation

Concerns around DoorDash center around unit economics. There are worries about each incremental order being money-losing and scale not being applicable to the delivery business. The graph to the right shows how when consumers make DoorDash a regular activity, repeat users become a greater proportion of marketplace GOV. This increasing proportion of Marketplace GOV from existing users has implications on unit economics as well, by improving operating leverage as sales, marketing and promotions spend associated with new users is much lower than for new users. Older cohorts are leading to contribution profits as a % of Marketplace GOV, showing that at scale, DoorDash will be profitable. But DoorDash is already showing scale, since they’ve reduced the consumer fee by 20% over the past 3 years, despite the increase in contribution margins.

There is a contribution loss in year 1 due to spend on customer acquisition. And DoorDash levels out its re-engagement marketing spend to 2% of gross order value, so gross profit is 10% of GOV as cohorts age. This means DoorDash is investing 7-10% of GOV to acquire a customer in Year 1. That customer generates 5-8% of GOV thereafter. As this base ages, scale and operating leverage kick in, implying a 12-18 month payback on customer acquisition, and 3-4x LTV/CAC after 3 years.

DashPass is arguably the most important development in the last-mile delivery industry, and it might end up being one of the largest subscription products in the US, reaching Netflix and Spotify status. The subscription element creates a direct relationship with the customer and its related cash flow generation gives DoorDash more flexibility over time, including the ability to lower delivery prices by a lot. The dynamic will likely be similar to Amazon Prime, where the more products and foods they will deliver, the lower prices will go. DashPass penetration is the most crucial output of DoorDash’s success.

DashPass is already successful, as 30% of total DoorDash customers are members, indicating that customers appreciate the free delivery.

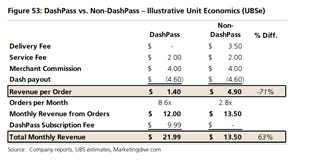

According to UBS, while DashPass subs generate 63% more total revenue over the course of a month given the higher frequency (almost 3x more orders per month for DashPass vs non DashPass users). Reducing delivery costs has increased transaction activity. We saw a similar phenomenon in securities’ trading, as 0$ commission increased trading activity greatly, favouring platforms such as Robinhood. DoorDash’s free delivery for DashPass users has similarly increase deliveries.

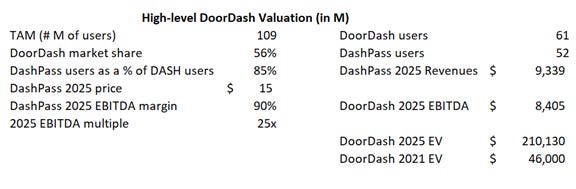

UBS stated that consumer penetration will reach 109M active users on food delivery platforms in the US by 2025. Assuming DoorDash maintains its 56% market share, 61M people using DoorDash. I assume most of these people (70%) will be using DashPass by 2025, taking advantage of unlimited FREE delivery. Consider that Amazon Prime enjoys greater than 85% of US household adoption, with over 125M Prime users.

The universe of deliverable items will expand to convenience store items, basic household essentials, medicine, etc. A larger selection of deliverable items means occasional users will become regular users, increasing DashPass’s value proposition, increasing the platform’s pricing power. The most dominant last-mile logistics platform will also have the most merchants on its platform, thus increasing customer value-add and retention. I think DashPass will reach a price 15$/month by 2025, with 90% margins.

All DoorDash needs to do is run its non-subscription part of the business at close to break-even, to cover its fixed and variable costs, and DashPass’s revenues will be almost entirely incremental to the bottom line.

I ran a model in two parts (DashPass business and non DashPass business), with an 11.7% take rate in 2025 and 30% CAGR growth in Marketplace GOV, which gave me 106$ a share for that business.

Ultimately, DoorDash has changed behavior at a huge scale in a remarkable way, by getting people to order their food online instead of by phone. The local delivery market is a winner-take most game and the flywheel has already tipped in DoorDash’s favor. At scale, customer acquisition costs will plummet and DoorDash will upsell several high margin services to its merchant and customer base and become a dominant American subscription product.

Risks

Dashers could churn to another aggregator platform who provide greater earnings. Merchants could churn, and so could users if they perceive greater value elsewhere. This market is a race, and DoorDash will have to win for DashPass to be the supreme winner. The flywheel is, after all, the most important part of the business model.

Autonomous driving could be either a risk or an opportunity for DoorDash. The company is already investing in drone startups and establishing partnerships with autonomous vehicle OEMs. But even if drones somehow replace the need for Dashers, DoorDash will be left with a two-sided marketplace business model with much lower delivery costs. I believe that drones and autonomous vehicles will merely be used to serve on non-economics positive routes, helping Dashers maximize their time on well-paying delivery routes.

Poor capital allocation: as seen by peers such as Just eat Takeaway, who bought Grubhub. As the market consolidates, DoorDash will have to be careful in where it spends its money.

The greatest risk to DoorDash is execution risk. To become the top last-mile delivery platform across several verticals, Tony and his team will need to keep on executing.

Metrics I’ll be tracking

Marketplace GOV, revenue growth, adj. EBITDA, operating leverage (S,G&A and S&M as CAC come down), Dasher earnings, merchants & new partnerships, new verticals, market share, DashPass subscribers, Storefront and Drive revenues & total customers.

DoorDash, for better or for worst, is creating the reality that comedian Ronny Chieng outlined in his 2019 special.

feel free to reach out to me at secretcapital@outlook.com

Enormous thank you to Tegus for their valuable insights. Tegus interviews are between interested stakeholders and company insiders. I’m often amazed at the quality of insights on Tegus, and have definitely spent an entire weekend or two just reading those interviews. Netflix should include Tegus in its competition! (not a paid partnership or anything, just a happy Tegus subscriber)

I'm looking to work at a public equities fund. Currently work in PE. Feel free to email me at secretcapital@outlook.com to chat more.

How do you make money if the revenue per order on a dash subscribtion is $2.50? Delivery cost per order must be at least $3 + overhead/support