JD and Alibaba: David and Goliath Can Both Win

On the surface, it seems like Alibaba is handily winning the Chinese e-commerce game. Alibaba’s platforms generate more than 3x the GMV JD does (1T$ vs 300B$ USD), their gross margins are almost 30% higher (44% vs 15%) and the traditional network effects of online marketplaces point to Alibaba being the runaway winner in this game.

But reality is far more nuanced, as JD’s relentless focus on customer service through quality and authenticated merchandise as well as a seamless logistics infrastructure has allowed them to compete against the mighty Alibaba, who focuses on volume more than customer service. Below is a comparison of both companies and a description of a rising China. After that is an appendix which includes a high-level overview of both companies.

Comparison JD vs Alibaba

The biggest difference between JD and Alibaba is around their supply chains. Retail shipping was historically inefficient in China and each inventory needed 7-8 movements from factory to customer. This problem was particularly painful in rural areas, since products could see several levels of price mark-ups as they moved through many distribution layers. JD’s high efficiency retailing and transparent pricing helped farmers stop getting ripped off with fake and expensive seeds, fertilizers and other goods. JD offers just one layer of distribution, solving what used to be several layers as the goods get to other cities. This competitive advantage had to be built brick by brick, in each city, as they went. Kathy Xu, an early JD Investor through her fund Capital Today , mentioned Richard Liu was building distribution centers in several cities when there were just 20 orders in the entire city and the break-even for those centers was 2000. JD now owns its own warehouses and employs its own last-mile delivery personnel throughout China.

Alibaba is not as laser-focused on its supply chain as they are a marketplace first model. Within its Cainiao logistics platform, Alibaba does not have direct power and has 14 different third-party delivery partners. All its partners need to make a margin of profit. Alibaba has stakes in all its logistics partners but many are still owner controlled. This integration via partnership is weaker than the deep vertical integration JD benefits from. The Covid-19 pandemic showed the power of JD’s integrated model, as they were the only player who mastered same-day delivery even in highly affected regions like Wuhan. The supply chain distinction shows the focus JD has on its customers, as its self-operated logistics allow its users to benefit from reliable, fast and quality delivery services.

Alibaba started out as a digital marketplace, which does not own the inventory of the merchandise they sold. Their multiple has come down over the past few years (from 22x ev/sales at IPO in 2014 to 7x ev/sales today) as they have had to build out an inventory and supply chain infrastructure, which is eating at margins. They effectively went the exact opposite direction as Amazon, who started as a 1P platform and is now growing its 3P platform. JD is going in a similar direction as Amazon, starting out with an asset-heavy model by owning inventory and its own logistics network. JD was building its distribution centers at a time when even Amazon in the US was using FedEx and UPS.

The reason for this focus is that Richard Liu, CEO and founder of JD noticed early that 80% of customer complaints centered around delivery problems and so focused on building out warehouses in operating cities. Liu’s mission was simple: provide better services to customers, delivering faster, with transparent pricing and authentic, quality goods and they’ll return. Compare this to Alibaba’s Taobao platform which is filled with inauthentic and low-quality goods. One of JD’s implementations was to build confidence and trust in e-commerce, such as by the tracking of every sale in order to ensure quality and authenticity. This tracking also meant JD paid its fair share of taxes, which used to be unusual in China. Liu made difficult decisions even if others doubted him to accomplish his goals. The logistics system he built cost 1B$ in 2007, which would have bankrupted the company if it didn’t work out but Liu was convinced it was necessary to solve the problem of slow, late and damaged shipment of goods and to win customers over for the long term.

Liu catered to his deliverymen by paying them high wages even if they were historically mistreated in China, since Liu realized they were the largest source of face to face interactions with customers, which could make or break the business. Liu spends one day per year doing deliveries to get a firsthand feel of the process. Liu even makes sure that 70% of promotions are internal due in large part to great internal training through JD University because he is focused on fostering a solid internal culture.

Richard Liu kissing the hands of one of his deliverymen.

Jack Ma at Alibaba preferred to be asset-light, with a focus on volume rather than delivery and customer service. And so JD benefited from a 3-year head-start. Their superior logistics network has born fruit consistently, and particularly during the Covid-19 pandemic. For example, as mentioned above, JD was the only e-commerce company delivering to Chinese citizens during the pandemic in under 24 hours in all areas, including Wuhan. JD was also growing its grocery retail sales in double digits during Q1-2020 when Chinese retail sales were down double-digits. The delivery to Wuhan accomplishment was the result of years of incremental gains for JD, such as through its 211 program, which commits JD to providing same day delivery for orders submitted to 11AM and next day delivery (before 3PM) for orders submitted before 11PM, which set a new standard in China’s e-commerce sector. JD’s reputation is now entrenched, thanks to its quality assurance, authenticity and quick delivery.

Alibaba’s Cainiao model is more like a Visa or Mastercard network that sits on top of existing logistics providers everywhere. It can scale quickly globally so that imported and exported goods by Alibaba can be done at large scale. This contrasts with JD’s more deliberate, localized supply chain model which prioritizes quick, efficient and personalized delivery.

However, JD is now expanding into the more asset-light marketplace business as well, so they are a long-term margin expansion story. Alibaba and JD’s business models (3P vs 1P) are thus converging over time, but that Alibaba is now pumping billions into Cainiao validates JD’s strategy.

The logistics infrastructure JD has built is also beginning to translate into other markets, such as the market for online groceries and community group buying. In the model, a community leader buys goods in bulk for their neighborhood from e-commerce platforms at a discount and the handles the distribution, which solves the costly and complex process of last-mile distribution. It also brings online grocery to older folks, who might not be as familiar with the Internet as younger generations. The Chinese grocery market is still dominated (80%) by wet markets, and just 6% of fresh foods sales were online in 2019. Big supermarkets are popular but not as entrenched as in the West. Credit Suisse expects fresh goods and household goods to reach 4.2T yuan in 2025, from 0.9T yuan last year. Both JD and Alibaba can do well in the space, but JD can leverage its logistics and supply chain advantages better.

Credit to Alibaba for getting the asset-light business model right at the beginning, connecting merchants and consumers, without needing to purchase inventory, warehouse goods or provide logistics. However, Alibaba’s market share for its marketplace is dipping now. It had 83% market share for Taobao/Tmall in 2016, which is now down to 77% market share.

Alibaba has also been accused through the recent anti-monopolistic measures of forcing small brands to choose between Tmall and other platforms. Meanwhile, JD’s market share has increased from 21% in 2016 to 24% 2019 and stands to benefit from merchants wanting to diversify the platforms they are present on. Indeed, there will now be no cost for merchants to have stores across multiple platforms, and they will prefer freedom to multi-list across platforms.

The nuance here is that the Alibaba ecosystem is completely blocked from WeChat (which takes up 50% of Chinese users’ mobile time). This blockage has been quite beneficial to JD and Pinduoduo in terms of traffic, advertising and customer acquisition. While Alibaba is the initial target on antitrust action, they would benefit if Tencent is required to unblock WeChat.

JD has been supportive of Chinese antitrust regulation: ‘’JD fully supports the antitrust regulation, which we believe is very important for healthy growth and innovation of the business ecosystem,’’ said Jon Liao, JD’s chief strategy officer.

Alibaba has been losing share to JD, as mentioned previously. More merchants are finding JD Logistics attractive. Merchants in JD Logistics get surfaced higher in ranking and can deliver faster as JD can better allocate placement of products closer to demand. Customers buy more because they have more visibility and faster delivery, leading to a superior buying experience.

Higher level, as lower-tier Chinese become wealthier, they will want better quality goods and will be ready to pay up, where JD will stand ready to capitalize on years of goodwill.

Alibaba has been a visionary in a few areas, before JD, such as commerce, payments (Alipay), and the cloud. But they do not have decentralized decision-making authority, in contrary to JD. Richard Liu has delegated power several times, such as by resigning from his positions as the legal representative or executive roles for 52 subsidiaries of JD since the beginning of 2020. The decentralization at JD allows for business units to make their own decisions and thrive.

Alibaba has not achieved the same level of decentralization and the Board of Directors retains most of the decision-making power despite the great complexity of the business. Reports of recent high management turnover at Alibaba’s acquired companies (ex: Lazada) have also highlighted the lack of decentralization at the company, where an employee indicated that all target KPIs are determined at HQ without input from the acquired company, restructure once these KPIs can’t be achieved and fire old employees. If the restructuring doesn’t work, the company is shut down.

Macro: the Rising Tide that is China

China’s middle class is rapidly developing, and this population’s consumption needs and wants are approaching developed market levels. These consumers want high quality products and are pursuing brands and imported products. Both JD and Alibaba’s platforms benefit from the trend.

Accompanying the rise of the middle class is the rise of lower tier cities. China has more than 150 cities with populations of less than 1M. These cities amount to 600M+ people and a consumption economy of 3.3T$. It is projected that 300M people will move from rural areas into these cities over the next 10 years. Projections are that consumption from lower-tier cities will go from 3.3T$ to 8.4T$ by 2030, according to Morgan Stanley. As Internet adoption and living standards improve, the e-commerce growth in these areas will be substantial.

Online gross merchandise volume will grow at a mid-teens CAGR over the next 5 years, thanks to rising consumption as the Chinese retail market is equal in size to the US despite 4x as many consumers and increased penetration of retail by online, a trend accelerated by Covid-19.

The Chinese economy also went straight to smart phones, where users spend most of their time. 65% of China’s population are Internet users, compared with 95% in the US, and as adoption increases, both JD and Alibaba’s marketplaces will become more powerful as merchants and users increasingly transact through online platforms. Digital marketplaces and retailers are benefiting and taking market share away from physical retailers. Penetration for all major product categories is still in its early days in China so the runway for growth is still long:

Kathy Xu, an early investor in JD through her fund Capital Today, has mentioned how online retailers are a lot cheaper than offline retailers and rural Chinese users are particularly sensitive to prices since their focus is to save as much money as possible to send their children to developed towns for college. Rural users have also been underserved geographically so far, meaning that the runway for growth is long. Many online players will benefit from this willingness to save by rural consumers, and it won’t be a zero-sum game.

Ultimately, Chinese e-commerce is a rising tide and has a long runway of growth thanks to increased penetration into lower tier cities, increasing consumer disposable income and saving and consumption trends, increasing Internet adoption rates and taking share from the brick and mortar retail industry. In conclusion, it’s not a zero-sum game well and both Alibaba and JD will do well, as the TAM for Alibaba and JD is all of China retail.

email: secretcapital@outlook.com

NOT a paid advertisement or partnership: Shoutout to Tegus, the platform which provides expert interviews. It makes it quick & easy to catch up on a company. It’s probably the most valuable professional research tool I have, along with CapIQ.

Appendix

Alibaba Business description

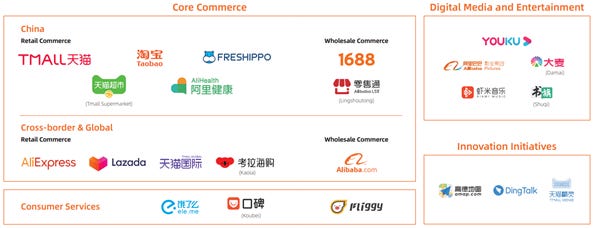

Alibaba was founded in 1999 by Jack Ma, who put together 80 000$ from 80 investors to start an online B2B marketplace for Chinese companies. They’ve since launched B2C and C2C marketplaces (Tmall and Taobao). Alibaba’s businesses include cloud computing, digital media and entertainment and innovation initiatives. Ant Group, an unconsolidated related party, provides payment services and offers financial services for consumers and merchants on their platforms.

The Alibaba digital economy includes consumers, merchants, brands, retailers, 3rd party service providers, strategic alliance partners and generated 1T$ USD in GMV and has over 780M consumers in China.

Alibaba owns Taobao (searching for treasures in English), a B2C platform launched in 2003 that charges no transaction fees to either sellers or buyers. They make money by charging sellers for advertising who pay to get themselves in front of users. This advertising has made Alibaba’s one of China’s largest advertising platforms. They want to gather as many merchants as possible so they can compete for the attention of buyers. It has 8M+ storefronts and 1B+ product listings. Taobao is full of small merchants and no-name products so consumers can have a lot of choice.

Alibaba’s divisions include Elema for food delivery, Autonavi for maps, Youkou for video streaming and Feizhu for travel booking. Alibaba’s properties in all these verticals show its strategy of being a part of all parts of a users’ lives, from social network to food to entertainment to travel preferences. Alibaba can also leverage the data from consumer purchases on Tmall and Taobao to figure out user likes thanks to the Unified ID, which tracks how users interface with Alibaba’s services. where they live, payment information, their social network, etc to cross-sell these users with its different services.

Baba also launched Tmall in 2008, a more expensive but trusted source for many shoppers to get the world’s leading brands. It’s overall a more upscale online shopping environment, with brand-controlled official flagship stores, like how the physical Harrod’s in London has several smaller luxury boutiques within its own store.

Alibaba owns the Cainiao cooperative logistics affiliate, which is operated as a 3rd party platform. Cainiao has 15 strategic express courier partners in over 700 cities and 31 provinces.

Alibaba’s Competitive Positioning and Moat

Individuals, small businesses and enterprises in China set up digital stores on BABA’s marketplaces Taobao and Tmall. These marketplaces have strong network effects due to the nature of the two-sided platform. The more consumers shop online, the more merchants and enterprises list items. The more items are listed, the more valuable the online store is for consumers, which attracts even more consumers. As Alibaba scaled, they included value-added services for both merchants and consumers. Services are built on top of the merchant’s digital stores, like inventory management and accounting, making switching more inconvenient. Merchants can setup stores and advertise to drive traffic to their online shops.

As customers stay on Alibaba’s platform longer, the ARPU of these consumers increases. For example, customers who came to the platform in 2016 increased ARPU 4x by June 2020. This shows the convenience of online shopping catching on with users.

Alibaba’s Cloud Opportunity

Alibaba’s cloud opportunity is probably its biggest call option. China’s cloud computing sector is minuscule compared to the US. Public cloud spending in China accounted for 3.4% of China’s IT spending vs 10.4% in the US, according to Gartner. Consider that Chinese cloud spending should improve to 15.8% of total IT spending by 2024, a CAGR of 28.3%. Management claims AliCloud can be as profitable as AWS (26% operating margins), even though Alipay is unprofitable as of now. Alibaba has by far the most market share in Cloud computing in China and growing 60% YoY. It also only makes up 10% of total revenues now but could easily double over time.

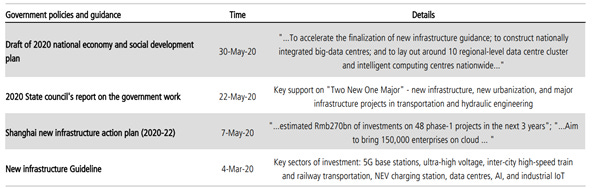

Furthermore, there are multiple policies and guidance favouring digital infrastructure and development of cloud adoption in China:

The nuance is that China’s cloud might be dissimilar to the Western one. The Chinese are not willing to pay for just off the shelves SaaS tools but rather they want full customized solutions from providers before they feel payment is justified. The bigger players are more likely to develop their own in-house solutions due to fear of espionage by Alibaba, Tencent, and other cloud players. This means end state margins might not be the same as in the West, but the cloud is still an opportunity for Alibaba. Its applications go beyond SaaS, they also extend to gaming and cloud computing for example.

Overall, the cloud sector in China is very small compared to the American landscape and has a long runway for adoption. Alibaba is by far the biggest player in the category and seeing large growth. And there are massive macro tailwinds, helped by regulatory activity.

JD Business Description and Moat

JD is China’s largest e-commerce company after Alibaba in terms of transaction volume, offering a wide selection of authentic products at competitive prices, with speedy and reliable delivery. Their GMV is over 300B$ USD and their platforms have 370M+ users. They’ve built their own nationwide fulfillment infrastructure and last-mile delivery network, staffed by their own employees.

JD’s nationwide fulfillment infrastructure covered almost all countries and districts across China, with over 700 warehouses in over 85 cities. They provide fulfillment services to online retail customers, well supported by self-operated integrated logistics infrastructure.

In JD’s online retail business, they purchase products from suppliers and sell them directly to customers. On their marketplace, all 3rd party merchants must meet strict standards for product authenticity and service reliability. Note that Alibaba does not have these same strict standards around authenticity and service reliability.

Partnership with Tencent: JD acquired Tencent e-commerce business and assets from Tencent, which has the largest online community in China. Tencent offers a wide variety of internet services in China, including social communications, online games, digital content and payments. They have the largest user base of over 1.2B people. Under the partnership, Tencent offers access to its mobile apps and helps get user traffic from the large mobile user base and enhance their customers’ mobile shopping experience.

Over the years JD has established itself as a trustworthy retailer with authentic merchandise. This is crucial since the majority of revenue comes from big-ticket items like electronic and home appliances items. And since JD’s delivery speed is the fastest in China, it can leverage its warehouse network to deliver its direct sales orders within 24 hours in China. It is much faster than competitors’ solutions and becomes a key differentiator in lower-tiered cities.

Social and online media platforms are yet another great opportunity for Chinese e-commerce. Users are increasingly turning to a different approach when discovering, exploring and learning about new products and brands. UBS forecasts 71% CAGR growth for live streaming e-commerce GMV over 2019-2022E. Both Alibaba and JD will benefit with their entertainment and celebrity platforms partnerships. Tencent’s partnership with JD here will be particularly valuable. Tencent aims to close the e-commerce loop within its platform, by building out capabilities so it can offer brands a place to acquire, interact and engage with users who then make purchases on JD’s platform.

Note that both Alibaba and JD both have a lot of call options as seen by various listed or large unlisted entities they own today which I didn’t mention in this piece. Both have large digital healthcare providers that are listed. JD has a smart city building unit, a government cloud business and fintech as a service while Alibaba’s Ant is evolving into a bank holding company selling several financial products. Alibaba also has Youku Tudou, the 3rd largest streaming company in China and ele.me which is the top competitor to Meituan in the food delivery business. The value of these call options may not be priced much today and can compound over time.