Business description

Roku is the market leader in the streaming TV industry, with 43M accounts. The business has two segments, Player and Platform. The Player segment consists of Roku’s hardware, its streaming devices, while the Platform segments (70% of revenues, up from 45% in 2017) consists of revenue generated from the Roku operating system, including advertising revenue (most of the revenues), subscription revenue and transaction revenue. The Player segment carries gross margins below 10% as Roku prioritizes its installed base rather than profit in this segment.

Roku pioneered streaming to the TV and was founded on the belief that someday all TV content would be streamed, as opposed to the traditional linear TV format. Roku was founded in 2002 by Anthony Wood. He previously served as VP of Internet TV at Netflix.

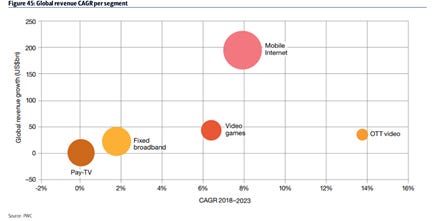

Roku is one of the top players in the Over the Top (OTT) ecosystem, which refers to the delivery of content over the Internet, without the involvement of a system operator like Comcast or Charter. OTT is commonly known as streaming. By bypassing traditional video distribution channels (cable, broadcast or satellite), OTT services negate the need for a TV subscription service. OTT services gained a lot of popularity in recent years, as faster internet capabilities improved viewing experience through streaming. Below is the growth of the OTT market:

An overview of the different OTT monetization models: SVOD, AVOD and TVOD:

-subscription video on demand (SVOD) services are like traditional TV services, where a user pays a recurring monthly fee to access a video content library. Large SVOD services include Netflix, Hulu and Amazon Prime Video.

-ad supported video on demand (AVOD) services are like SVOD services but monetize primarily through ad revenues. AVOD services normally offer either no or reduced monthly subscription fee. AVOD services differ in their ‘ad load’, or the number of minutes dedicated to ads per hour of viewing (ex: YouTube).

-transactional video on demand (TVOD) services give the option to purchase or rent video content for a fixed, one-time rate.

Roku’s mission is to be the streaming platform that connects the entire TV ecosystem. Central to their platform is the Roku operating system (the Roku OS). The Roku OS is purpose built for TV to run on low-cost hardware which enables them to manufacture and sell affordable streaming players. The Roku OS also powers Roku TV models that are manufactured and sold by their TV brand partners who license the Roku OS and leverage their smart TV hardware reference designs. In 2019, 1 in 3 smart TVs sold in the US was a Roku TV, and Roku is well on its way to becoming the de facto operating system of Smart TVs in the US – it already has the #1 position. All Roku devices enable users to access a wide selection of content by connecting their Roku device to their streaming platform via a home broadband network.

Three core activities drive their business model. They focus on increasing the number of active accounts that use the streaming platform to watch TV (which drives scale), increasing user engagement and growing the hours of content streamed (offering premier subscription streaming applications, along with free content like the Roku Channel), and user activity on their platform.

Value-add and growth of streaming: While subscription-based applications like Netflix get most of the headlines, free ad supported TV is an important part of the streaming market as consumers become more reluctant to pay for additional subscriptions (there are a lot right now, as you know). Roku receives a portion of the ad inventory from ad supported TV apps and demand for these apps is growing strongly.

Cord-cutting: a Tailwind for Growth

OTT has become intertwined with the concept of cutting the cord, users cancelling their subscriptions to multichannel subscription television services available over cable or satellite. However, the actual content from traditional TV, especially live sports, will continue to have a large following. This content is viewed is often through a streaming app. The growth of this alternative way to watch TV is expected to grow at a double-digit rate and often through streaming devices like Roku. Below is the decrease to come of traditional TV subs. Smart TVs and Roku will grab the market share of course.

Value-add for all Stakeholder: A Key Competitive Advantage

One of Roku’s greatest competitive advantages is its skill in developing strategic partnerships with various parties that deep pockets alone could never reproduce. Below are the stakeholders Roku deals with (users, content publishers, TV OEMs, advertisers), and how their interests are aligned with Roku’s:

Users: through their streaming platform and devices, Roku makes it easy and affordable for users to watch shows and movies as well as listen to streaming audio. The platform offers users a streaming experience through a user interface that is easy to use and navigate. From the Roku home screen, users can access the 500k+ free and paid movies and TV episodes including live TV, news, sports, shows, etc. Users control the amount they spend on streaming content by choosing content that is available on an add-supported, subscription or transactional basis.

Roku also has fewer ad slots, so they’ll show fewer ads. That means a better consumer experience, which would differentiate them vs a linear TV. They’re anywhere between 25% and 50% of the total ad load relative to a traditional linear channel.

Content publishers: Roku enables content publishers to build audiences and monetize their content on their streaming platform. Content publishers can deliver content directly to their large and relevant audiences to reach those users who no longer use or those who never used linear TV or paid TV subscriptions. As consumers shift to TV streaming, content publishers that use their platform can reach these streaming audiences at scale and engage users directly. They make it easy for content publishers to distribute and monetize their streaming content through SVOD, AVOD and TVOD. After all, these content publishers need to be the platform that dominates distribution, and that’s Roku.

This dynamic is powered by the recent big shift from the power that content owners and producers have had, to the streaming platforms. These traditional content owners historically had power and control over where they distributed, how they distributed, and the terms of negotiations. Some of these content producers still want to build their own app to preserve the control but are realizing it’s not their core competency.

So Roku suggests that since they are great at building recommendation algorithms, surfacing the right content and at monetizing content and that content producers are great at producing content, that is a good division of labor. That power has shifted over to the platforms like Roku. It’s why you saw Peacock come over to the Roku platform last week - because the leverage is on Roku’s side even though Peacock has a jewel even Netflix doesn’t have: streaming rights to Premier League soccer.

Indeed, the streaming business is an app-stored business. Roku is merchandizing content to consumers. If we think about it as a marketplace business, there will be few smart TV operating systems or app stores that will garner most market share. It’s a self-fulfilling dynamic, scale brings more content which brings more eyeballs which brings more scale and so on.

The proof is that a couple of the bigger traditional TV OEMs have stuck with their proprietary operating systems and as a result, they’ve lost significant market share. Samsung had over 1/3rd of the market share 5 years ago. They’re now under ¼. LG has lost almost half their market share.

Roku also makes sure they have a win-win relationship with content publishers since there will be ad splits or revenue shares based on SVOD or TVOD.

TV OEMs: Roku provides value-add to TV OEMs since they help them get distribution with retailers OEMs previously didn’t have access to. 1 in 3 TVs sold today are Roku TVs. This is partly thanks to TCL’s ascendancy from 24th in US TV market share to #3 in 2018. This was driven almost entirely by Roku, since consumers want their TVs to have streaming operating systems embedded within it. Roku has 16 total partnerships with different OEMs.

It’s also hard to imagine smart TVs losing much market share to consume a lot of traditional TV content. There are 250M TVs sold annually. For example, on Netflix, 70% of streams are viewed on televisions, according to Netflix. In terms of traffic, Netflix was 50% of total streaming hours on Roku 3 years ago. The last time they updated it, Netflix was around 1/3rd of the hours streamed on Roku. So Netflix is still growing on the Roku platform. But other parts of the platform are growing faster around them. And Roku has called out free ad-supported content as one of their strongest categories and the fastest grower.

Roku also has a better mousetrap for OEMs, which has made Roku the #1 TV OS and has a lot more market share than other license operating systems. They have the only purpose-built operating system for TVs. That allows Roku to be run on low-cost hardware. So OEMs can use less powerful chips and a smaller memory footprint. That means it’s cheaper to build. So when negotiating with OEMs, Roku starts by giving OEMs a gift of a lower Bills of Materials cost. TVs are a low-margin hardware so this is a very important criteria for them. They provide a lot of other value as well. Lower return rates are important for retailers and TV OEMs. That’s because Roku’s UI is easy to use and to set up. They have their neutral positioning and their strong retailer relationships they’ve gotten in placement for OEMs they couldn’t get on their own.

The neutral positioning is also under-appreciated by investors. Players in the ecosystem, be it retailers or content producers or even TV OEMs would prefer to see a neutral party like Roku become the leader in the space than one of the other companies that have tipped over and tried to dominate other verticals (ex: Amazon and Google).

Advertisers: Roku’s streaming platform enables advertisers, including content publishers, brands and agencies, to reach audiences no longer reachable or are increasingly unavailable through traditional advertising on linear TV. Using their tools and advertising platform, advertisers can leverage their direct relationship with users, as well as user data and insights to serve targeted advertisements. Streaming TV also gives advertisers more flexibility to change their advertising campaigns and target certain audiences. Traditional TV advertising often relies on up front ad buying that can be difficult to change if something drastic happens. Advertising on CTV gives businesses the ability to adjust their ad spend based on current market conditions, not the market conditions a few months ago. It also provides diversification from Google/Facebook.

Roku is like Facebook: providing a great platform consumers spend time on, but then mostly monetize based on ads.

TAM: Roku is going after both the linear TV USD 70B$ market and the USD 130B$ digital advertising market. Roku’s LTM revenue was 1.35B$. And Roku is bringing in a class of performance advertisers who may not have traditionally invested in TV. For example, B2C brands, brands that spend a lot of money in social media because of the high ROI are coming to Roku and the segment was up 346% YoY in Q2. So Roku has expanded its TAM from targeting just traditional TV advertisers to even those who used to advertise exclusively on social media.

Roku is also doing a good job at expressing the advantages of advertising on streaming platforms, including data points on every single viewer, more flexibility on where and when to advertise and the ability to measure how often an ad translates into an online purchase, all of which should drive more dollars to streaming.

Roku has focused all its resources on building out the premiere streaming platform, instead of focusing on additional ventures, like original content. Roku has launched its own channel on its platform, which offers a variety of free and paid content. And unlike other ad supported TV options, the Roku Channel knows the exact consumers who are watching the content, due to the user being signed into the Roku platform. This data, along with trends about what else the user is watching on the Roku platform gives the Roku channel multiple advantages vs Pluto/Tubi.

Their acquisition of Dataxu, a demand side platform (DSP) a year ago is important since the DSP provides a platform for companies to buy advertising time and Roku has enhanced the platform by integrating its proprietary data into the platform, providing a differentiator vs other DSPs due to its large scale first party consumer data. Advertisers can buy ad time across digital platforms and provides easier access for small and mid-sized advertisers to buy time on the Roku platform, opening up new ad opportunities as historically Roku has focused its resources on large ad advertisers and agencies.

Dataxu provides advertisers with ROI on their spending which connects from consumers’ different devices. From this information, advertisers can see the conversion rate of consumers who see their ads on CTV and then go and actually make a purchase of the product or service on the company’s website. This type of measurable feedback on ad spend isn’t even close to possible on traditional linear TV and this is a key selling point to advertisers to continue to shift more ad spending to streaming.

This wealth of data means the company can sell targeted ads on the Roku Channel at a premium versus other ad supported apps. Additionally, with Roku being able to get premium pricing on ads, it encourages content providers to work with Roku to get its content on the Roku channel. Roku has indicated it can get some content providers 2x the ad pricing on the Roku channel vs a standalone app.

Roku also has better content recommendations. There might be too much content on streaming on Roku, which can be a negative. Because the Roku channel has information on what the consumer has watched across the entire Roku platform, it has the data to make better recommendations of what to watch within the Roku channel’s vast library. This also incentivizes content providers to partner with the roku channel since content is more likely to find the right consumers rather than be lost in a large library of videos. And so over time they will be more efficient at driving traffic into the Roku Channel based on more content, better algorithms and better opportunities to monetize. I think Roku Channel is well positioned to gain outsized share of ad revenue that is and will continue to be moved towards ad supported TV.

Growth of the digital ad market

Connected TV still only has a very small market share with digital ad spend. It is doubtful whether CTV catches up to mobile, but there is a long runway for growth. And as with mobile, ad dollars usually follow adoption of the platform. And adoption of connected TVs is far outpacing ad dollars on the platform. Ad revenue for US connected TVs did grow to almost 7B$ in 2019, up over 35% YoY and is expected to be close to 8B$ in 2020, and 15.6B$ in 2023.

To sum up, the Roku business model is: they have mass distribution through partnerships with 16 OEMs, which gets them audience reach. This audience reach allows them to appeal to advertisers while offering them a strong advertising product. The business also has tailwinds for growth from linear TV to connected TV.

Roku provides real value, mostly still unlocked, in its ability to provide aggregation, discovery, and management solutions to the consumer and monetize this highly strategic position with advertisers and content providers.

What do you think monetization, specifically ARPU, can look like in the future (next 5 - 10 years)? I'd guess it'll be somewhere between linear TV and FB ads. With the NBC - Peacock deal, Roku will not be collecting any ad revenue (https://www.engadget.com/nbc-peacock-now-available-for-roku-streaming-devices-144123980.html). NBC threatened to pull all other content from the platform if Roku held strong. Do you see this supplier relationship as a risk to future monetization? I'm trying to make sense of today's price - I like the company but it seems like a lot needs to go right in terms of monetization.